Tech

2. Data Becomes More Actionable

Marketers spend more and more time wrangling data so they can rely more heavily on it and do more with it.

Most financial institutions should be tapping three key streams:

- First-party data from their own database

- Second-party data from other institutions’ first-party data that is shared

- Third-party data purchased or acquired from external sources/suppliers.

Integrating all of that into a single database for maximum utility — building complete profiles of individual consumers — is a key foundation for future campaigns in the year to come. Increasingly this takes shape in a Customer Data Platform (CDP).

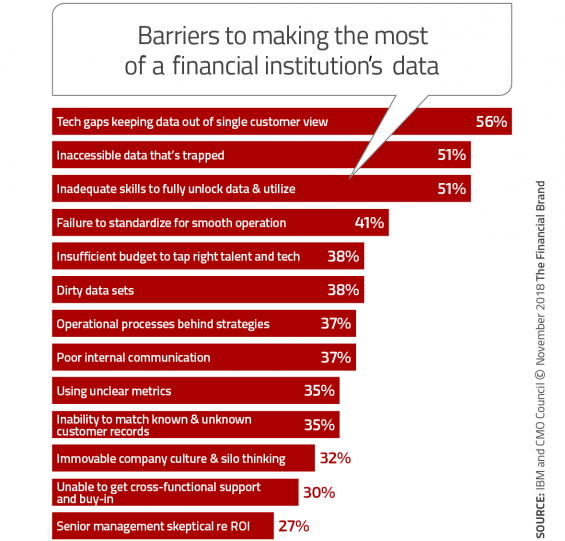

“Many teams lack the technical skills for this,” said Perrin, so typically they seek outside help. She noted that research by The Relevancy Group indicates that 50% of firms surveyed have engaged a CDP vendor and 32% plan to. A key function of CDPs is pouring data out of restrictive internal silos to get an enterprise-wide draw on data providing the unified customer view.

CDPs are the “new kid on the block,” according to Criteo’s Hanyaloglu, holding out the promise of a more-complete picture of the specific consumer that a marketer wants to pursue. They are not the same as the older, but still widely used Data Management Platform technology. A DMP typically contains broad and anonymous data on customer behavior from digital channels. DMPs tend to be used to turn third-party data into a proxy for first-party data.

Hanyaloglu said that the two data mechanisms — CDPs and DMPs — complement each other. “And over time there could be a merging of the two,” he added.

No comments